Homeowners Insurance in and around Taylor

A good neighbor helps you insure your home with State Farm.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

What's More Important Than A Secure Home?

Everyone knows having great home insurance is essential in case of a fire, tornado or hailstorm. But homeowners insurance is about more than covering natural disaster damage. Another helpful thing about home insurance is its ability to protect you in certain legal situations. If someone falls at your residence, you could be on the hook for physical therapy or their medical bills. With the right home coverage, these costs may be covered.

A good neighbor helps you insure your home with State Farm.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Agent Sandy Gilland, At Your Service

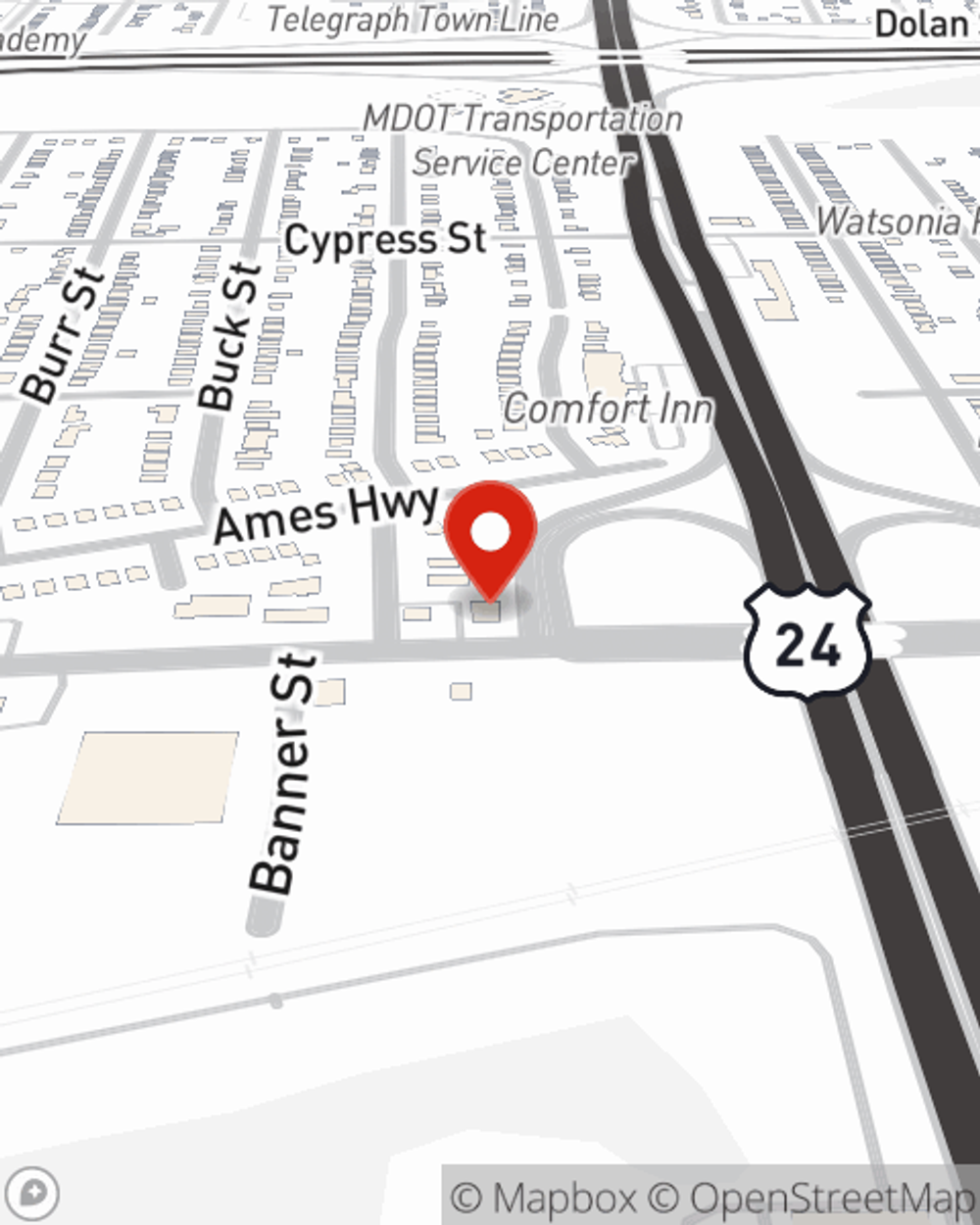

That’s why your friends and neighbors in Taylor turn to State Farm Agent Sandy Gilland. Sandy Gilland can outline your liabilities and help you select the smartest policy for you.

There's nothing better than a clean house and insurance with State Farm that is reliable and dependable. Make sure your valuables are covered by contacting Sandy Gilland today!

Have More Questions About Homeowners Insurance?

Call Sandy at (313) 295-5656 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Things to consider when replacing a roof

Things to consider when replacing a roof

When your house needs a roof replacement, you might wonder what material and warranty options there are. Learn about some questions to ask a roofing contractor.

Sandy Gilland

State Farm® Insurance AgentSimple Insights®

Things to consider when replacing a roof

Things to consider when replacing a roof

When your house needs a roof replacement, you might wonder what material and warranty options there are. Learn about some questions to ask a roofing contractor.